A State Cannot Collect Taxes From Which of the Following

Congress must tax according to the number of citizens there are in the country according to the Census. The 16th Amendment changed this so Congress could charge and collect taxes any way they wanted Clause 5.

Government Revenue Taxes Are The Price We Pay For Government

Ruth Mann salary 60075 1 exemption.

. The state where the subject to be taxed has a situs may rightfully levy and collect the tax. In all six states assets passing to the deceased persons surviving spouse and charity are exempt from the state inheritance tax. Which of the following is not an example of excise tax.

Loggers harvesting trees in a national forest D. Additional things that the state governments cannot do include. This appeal method is generally quicker than using the CDP option.

Theory of Accounts Integration 2. Maryland and New Jersey collect both state estate taxes and inheritance taxes. INTRODUCTION T O T AXA TION.

Not all goods and services are subject to sales tax in Pennsylvania. Chapter 1-5 income tax mc. Only statement 2 is true.

Which of the f ollowing inappropria tely describes the na ture of t axa tion- Gener ally for public. Congress cannot tax things sold from one state to another state. With this type of appeal you cannot appeal to the tax court.

Both statements are true. How States with No Income Tax Generate Income. With a CAP hearing it is available before or after a notice of federal tax lien is filed.

Sales tax is imposed on sellers not the customers of the seller. It is the state or political unit which has jurisdiction to impose a particular tax. Without funds the government cannot meet the various essential expenses it has incur to enable it to exist snd function effectively.

The situs is necessarily in the state which has jurisdiction or which exercises dominion over the subject in question. Tax condonation is general pardon granted by the government. The power of the state to impose and collect revenues for the operation of the government.

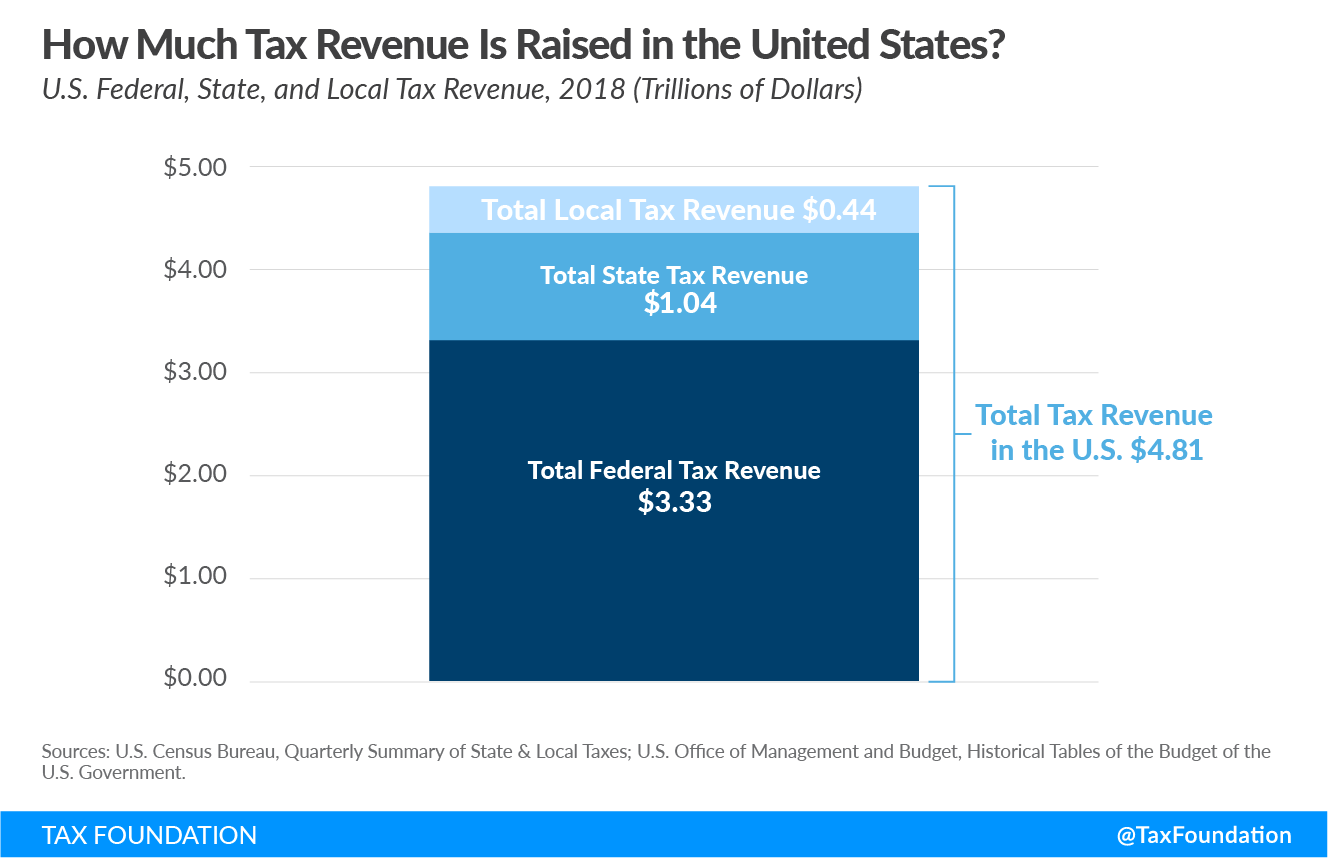

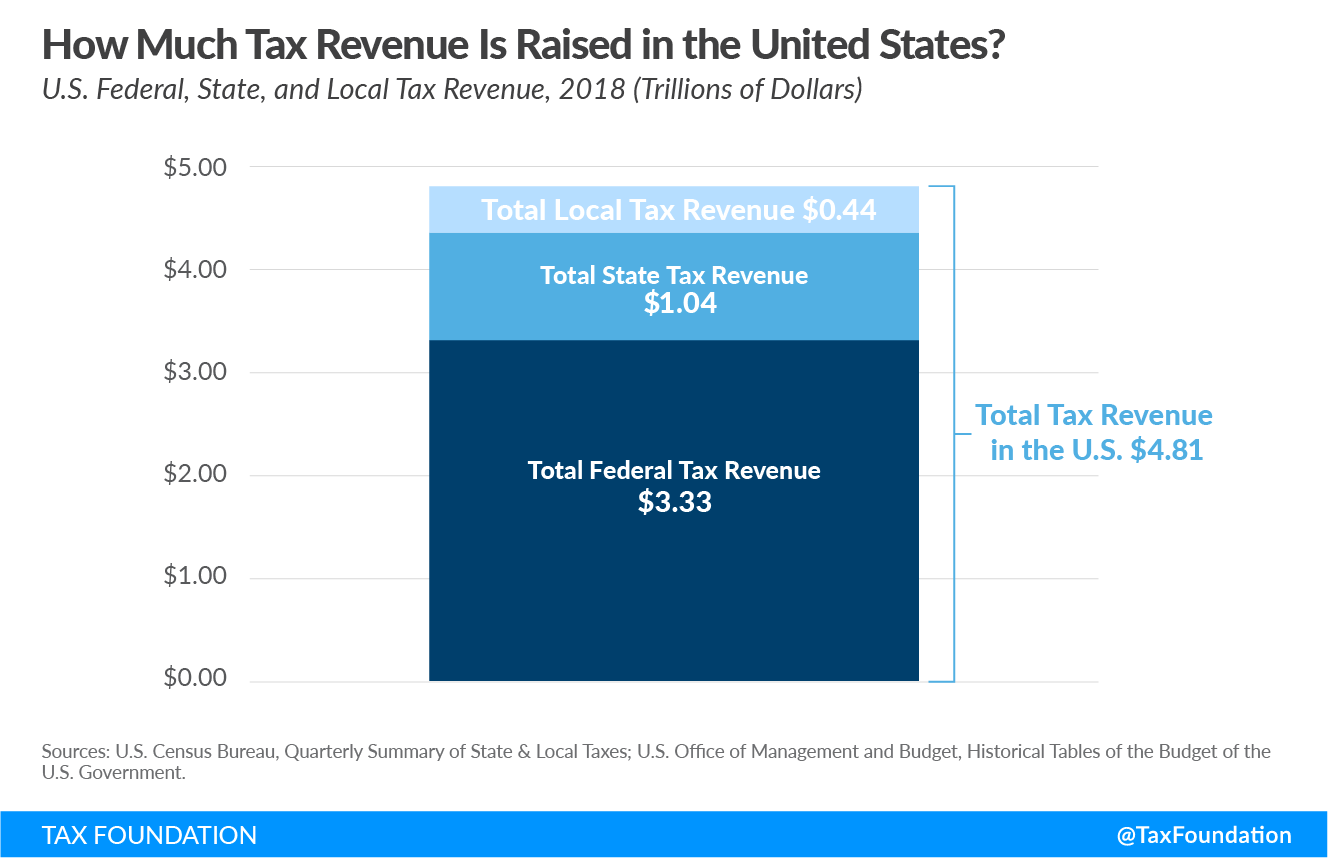

Collection Appeals Program CAP. - The power of the state to collect revenue for public purposes. State and local governments collect more tax revenue than the federal government.

History shows that it was the states that introduced personal income tax into America. The deduction for state and local taxes is no longer unlimited. Income tax The following are similarities of the inherent power of taxation eminent domain and police power except one.

Public Law 86-272 protects a taxpayer from which of the following taxes. Taxes the enforced proportional contributions levied by the law making body of the state by virtue of its sovereignty upon the persons or property within its jurisdiction for the support of the government and all public needs. Only statement 1 is true.

Find the salary and of exemptions on the chart and the in both sections is your answer Answer. The point a t which tax is le vied is also called- Impact of T axa tion. Additionally residents of Tennessee and New Hampshire are only.

States Without State Income Taxes Here is a list of states that do not impose income taxes. All the above are true. Real property tax B.

The President of the Philippines can change tariff or imposts without necessity of calling Congress to. Tourists staying in a hotel. C Ohio Commercial Activity Tax an excise tax with a gross receipts base.

City dwellers riding the subway C. Today most of the states require their residents to pay a personal income tax. The BIR has five deputy commissioners.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. In Iowa Kentucky Maryland and New Jersey assets passing to the deceased persons descendants are also exempt. Supreme Court has ruled that states cannot force retailers to collect sales taxes on purchases unless the retailer had an actual physical presence in the state.

The state generally cannot collect the sales tax directly from an out-of-state retailer since the US. Which one of the following statements regarding the taxes of state and local governments is true. Campers camping in a state park B.

The government can still collect tax in disregard of a constitutional limitation because taxes are the lifeblood of the government. 4 the levy of taxes must be for public purpose. Levy and collect taxes.

The president cannot declare war. Using the chart above find the state withholding tax for the following unmarried person. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return.

D California Franchise Tax a net income tax. The first modern personal income tax system was originated in 1911 by the State of Wisconsin. Alaska Florida Nevada South Dakota Texas Washington and Wyoming are the exceptions because they do not tax residents incomes.

This cap applies to state income taxes local income taxes and property taxes combined. Which of the following is the best example of a concurrent power of the state and national governments. These states generally use one of two methods to determine income tax.

This type of appeal can be contested in the United States Tax Court. B Washington Business and Occupation Tax a gross receipts tax. FACTORS IN DETERMINING THE SITUS OF TAXATION.

A state cannot collect taxes from which of the following. A Texas Margin Tax a tax with net income gross receipts and capital worth components. The state cannot require sellers to collect sales tax due on the goods and services they sell.

Congress cannot raise taxes. Govt agencies and GOCCs performing proprietary functions are taxable unless exempted by law. Governmental units performing purely governmental functions are exempt from income tax.

Issuing bills of credit as was the case in Missouri when it issued bills of credit to pay taxes which was later ruled as. The theory of taxation. The greatest source of tax revenue to state and local governments is sales taxes.

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

No comments for "A State Cannot Collect Taxes From Which of the Following"

Post a Comment